Once celebrated as the undisputed leader of the Indian two-wheeler industry, Hero MotoCorp is now facing one of the most turbulent periods in its corporate history. The legacy of the “Hero Honda” era, immortalized by the tagline “Desh Ki Dhadkan”, has faded.

In its place stands a company grappling with a declining market share, strategic missteps, and a leadership vacuum. As Hero MotoCorp slips to third place in an increasingly competitive domestic market, questions abound about its long-term viability and strategic direction.

From Market Leader to Market Laggard

The dissolution of the Hero-Honda joint venture in 2010–11 marked a pivotal shift. Hero MotoCorp, seeking global independence and technological autonomy, set out to chart its own course—directly competing with its former partner. More than a decade later, the results paint a sobering picture.

Hero’s stock is down nearly 40% from its all-time high, and sales figures are slipping. February 2025 saw a staggering 20% decline in year-on-year sales. Once the dominant force in Indian two-wheelers, Hero now trails Honda and TVS, having fallen to third place in domestic rankings.

The fall from the top has not just been numerical. It signals a deeper erosion of brand equity and consumer relevance. The company’s shrinking market share reflects systemic weaknesses: a lack of innovation, slow adaptation to evolving consumer preferences, and an overreliance on legacy models.

Leadership Exodus Raises Alarm Bells

Compounding its market woes is an exodus of senior leadership. In a span of days, nearly half a dozen other top executives, including CEO Niranjan Gupta, the Chief Business Officer, and Ranjivjit Singh tendered their resignations. Such abrupt departures from the C-suite raise serious concerns about internal disarray and governance stability.

Reports suggest a deteriorating internal climate punctuated by a tense town hall meeting in which Executive Chairman Pawan Munjal reportedly told underperforming employees, “My eyes are on all of you.”

The remark, intended as a call to accountability, may have instead accelerated discontent within senior ranks. Against the backdrop of ongoing investigations into Munjal himself—ranging from ED raids related to alleged money laundering to earlier tax probes—the leadership vacuum is both strategic and symbolic.

Missing the Consumer Shift

At the product level, Hero’s core portfolio is increasingly misaligned with current market demand. While the Splendor remains the top-selling model, newer preferences are moving toward higher-capacity motorcycles (125cc and above), where Hero’s presence is minimal. The company’s success in the 97cc to 115cc segment, once its strength, is now a liability.

| Bike | Jan 2025 | Dec 2024 | Jan 2024 | MoM% | YoY% |

|---|---|---|---|---|---|

| Splendor | 245,315 | 182,167 | 241,245 | 34.66% increase | 1.68% increase |

| HF-Deluxe | 62,223 | 41,713 | 78,767 | 39.46% increase | 21% decrease |

| Xtreme 125R | 21,870 | 17,473 | 0 | 25.16% increase | – |

| Super Splendor | 14,116 | 10,271 | 13,877 | 34.73% increase | 1.72% increase |

| Glamour | 9,715 | 6,022 | 15,494 | 61.32% increase | 29.99% decrease |

Take the HF Deluxe: once selling over 1 million units annually, its sales have plummeted to just 77,000 units in 2025. This sharp decline is not merely cyclical. It highlights Hero’s failure to evolve with the rising aspirations and disposable incomes of Indian consumers, particularly in urban and semi-urban markets.

Strategic Missteps in the EV Space

Perhaps the most glaring missed opportunity lies in the electric vehicle segment. Despite early-mover advantages in brand and distribution, Hero MotoCorp has secured a paltry 2% share of the EV market. In January 2025, the company sold just 1,615 EV units under its new “Vida” brand, a performance that is, by all measures, underwhelming.

A major impediment has been a branding conflict with Hero Electric, run by Naveen Munjal, nephew of Hero MotoCorp’s Chairman. A family settlement granted Hero Electric exclusive global rights to the “Hero” brand for EVs, forcing Hero MotoCorp to enter the market under the unfamiliar “Vida” label. The absence of the trusted “Hero” name has impacted consumer trust and brand recall.

Legal battles have further complicated the situation. A 2022 case filed by Hero Electric in the Delhi High Court remains unresolved, but the reputational and commercial damage is already evident. A more collaborative family strategy by leveraging Hero MotoCorp’s vast distribution with Hero Electric’s branding rights could have turned both players into formidable EV contenders. Instead, both remain peripheral in one of the most critical growth areas of the automotive industry.

Legacy Strengths and a Narrow Path Forward

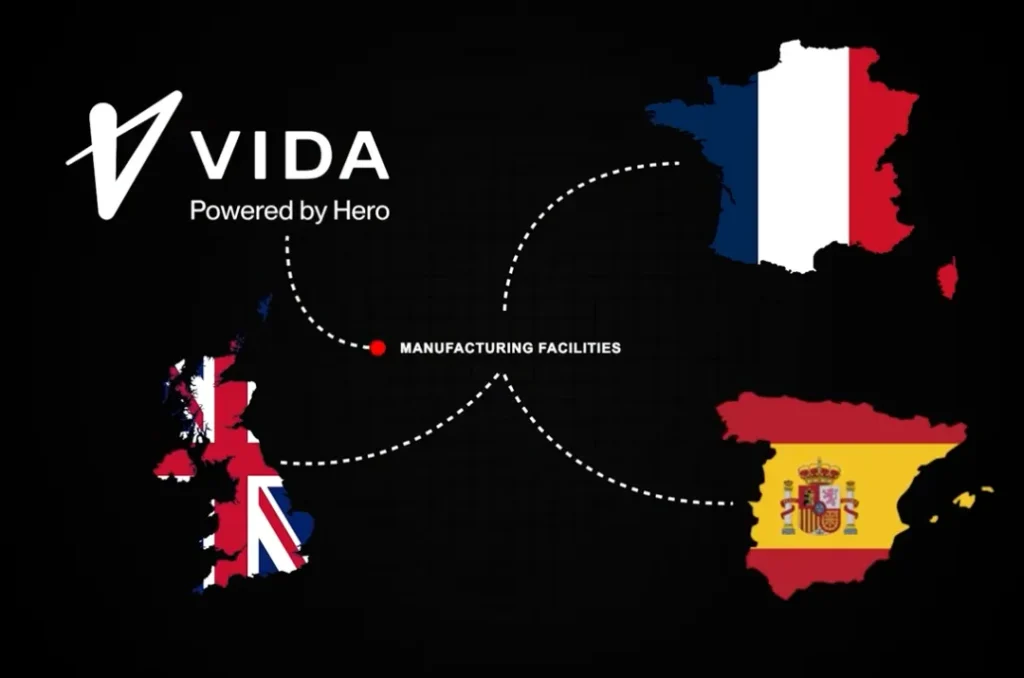

Despite its challenges, Hero MotoCorp retains a robust footprint in rural India, which accounts for 55% of its total sales. Moreover, the company is making cautious strides in global markets. In 2025, it launched the Vida EV in Europe and the UK, signaling its intent to diversify geographically and gain traction beyond domestic borders.

However, the path forward is precarious. The company’s fortunes now hinge on a successful leadership transition, swift product realignment, and the ability to reestablish internal cohesion. Whether Hero MotoCorp can reorient itself to meet evolving consumer demands, particularly in the premium and electric segments, remains to be seen.

The Battle for Relevance

Hero MotoCorp stands at a crossroads. Its decline from a position of unparalleled dominance to its current standing reflects not just market shifts but deeper structural and strategic lapses. The confluence of leadership instability, failure to anticipate consumer trends, and a mismanaged EV transition presents a daunting challenge.

Yet, with strong rural roots, an iconic brand legacy, and ongoing international expansion, the company retains latent strengths. The onus now lies on the incoming leadership to resolve internal fragmentation, align product strategy with future demand, and recapture consumer trust—especially in the electric mobility era. Whether Hero can once again become Desh Ki Dhadkan or fade into irrelevance will depend on decisions made in the immediate future.